richmond property tax rate

For information and inquiries regarding amounts levied by other taxing authorities please contact. PAY YOUR PERSONAL PROPERTY TAXES ONLINE OR BY MAIL.

Map Of Rhode Island Property Tax Rates For All Towns

Taxing units include Richmond county.

. Personal property tax bills have been mailed are available online and currently are due June 5 2022. We have done our best to provide links to information regarding the County and the many services it provides to. The City Assessor determines the FMV of over 70000 real property parcels each year.

Formulating real estate tax rates and conducting appraisals. These agencies provide their required tax rates and the City collects the taxes on their behalf. Building Department.

The general property transfer tax rate is 1 of the fair market value up to and including 200000. Under the state Code reexaminations must occur at least once within a three-year timeframe. Property Taxes Due 2021 property tax bills were due as of November 15 2021.

These documents are provided in Adobe Acrobat PDF format for printing. A portion of the fair market value exceeds 200000 and includes up to. A 10 yearly tax hike is the maximum raise allowed on the capped properties.

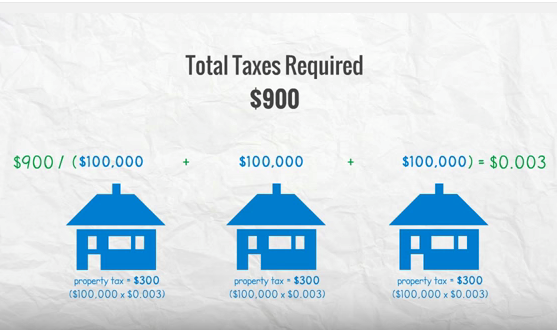

The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. For all who owned property on January 1 even if the property has been sold a tax bill will still. Welcome to the official Richmond County VA Local Government Website.

RICHMOND CITY HALL 450 Civic Center Plaza Richmond CA 94804. Along with collections property taxation involves two additional general steps. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as.

Richmond City Council is considering lowering the real property tax rate as property values across the city increased 13 on average from a year prior.

Fort Bend County Property Values Up 35 Percent Since 2012 Community Impact

A Comparison Of Property Tax Rates 2 Viewpoint Vancouver

This Is Where Toronto Ranks Vs Other Ontario Cities For Property Taxes

Interactive Map Prop 13 Subsidies

Richmond Va Cost Of Living 2022 Is Richmond Va Affordable Data Tips Info

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty

Real Estate Basic Facts Per Subdivisions Within Richmond Tx 77407

Wake County Approves Budget With 10 Property Tax Rate Increase Raleigh News Observer

Many Left Frustrated As Personal Property Tax Bills Increase

Letter Tax Burden Too Much To Bear Richmond News

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

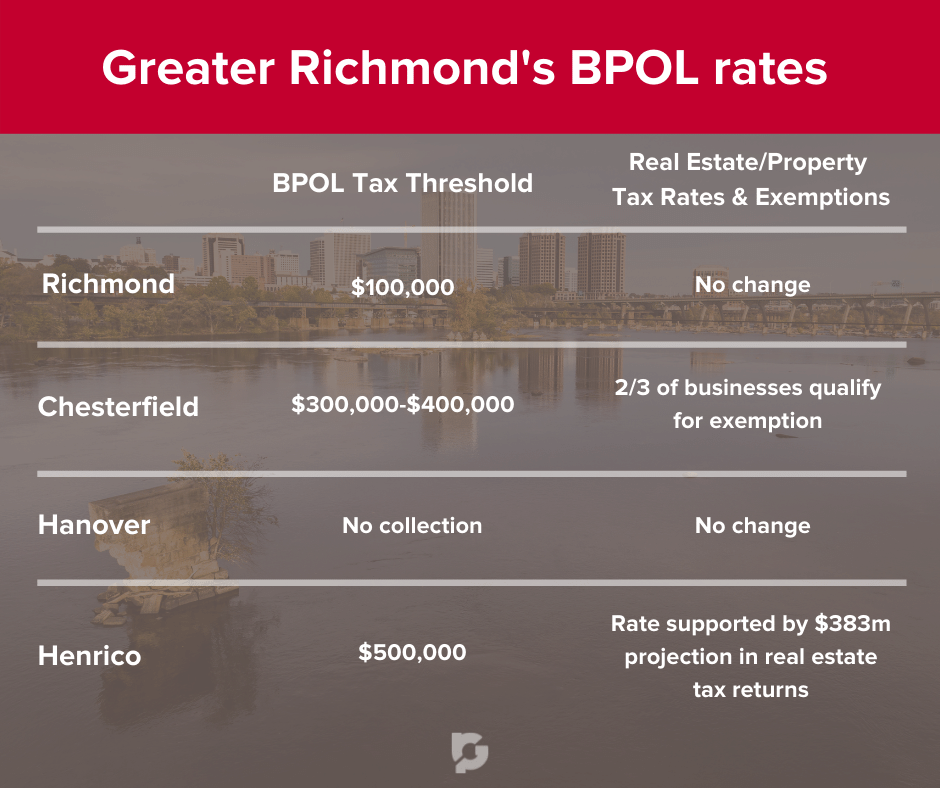

Localities Raise Business License Tax Thresholds Greater Richmond Partnership Virginia Usa

:format(webp)/https://www.thestar.com/content/dam/localcommunities/richmond_hill_liberal/news/2021/12/12/richmond-hill-council-delivers-second-consecutive-property-tax-freeze/10536070_FGLLru2VgA00vFi.jpg)

Richmond Hill Council Delivers Second Consecutive Property Tax Freeze The Star

Ontario Property Tax Rates Lowest And Highest Cities

New Tax Assessments Show Richmond Property Values Surging 7 3 Percent The Biggest Increase In A Decade Richmond Local News Richmond Com

New Tax Assessments Show Richmond Property Values Surging 7 3 Percent The Biggest Increase In A Decade Richmond Local News Richmond Com

Your Richmond Va Real Estate Questions Answered

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

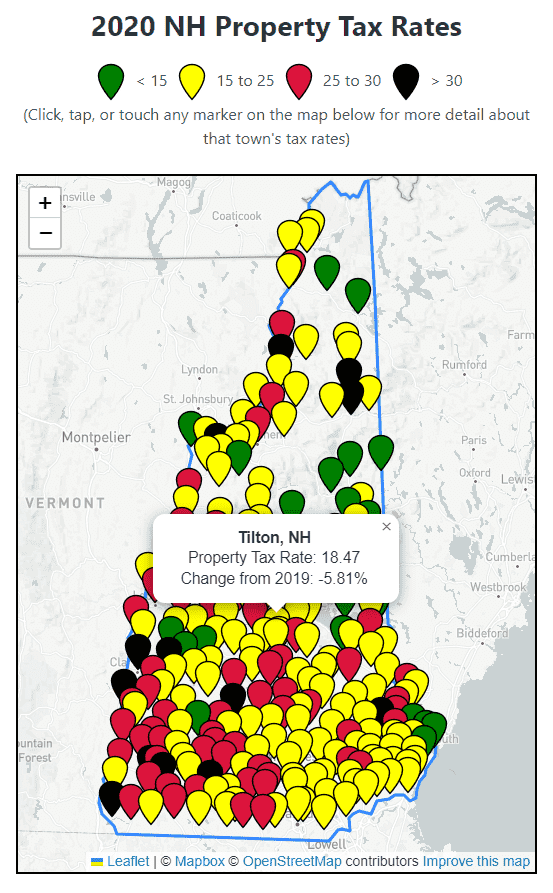

2020 New Hampshire Property Tax Rates Nh Town Property Taxes